At the beginning of the year, I was invited by the IBM Institute for Business Value (IBV) to join 44 IBM global experts—members of the Industry Academy and Academy of Technology—to reflect on key trends driving investments and actions in 2021. We identified the following eight trends that will dominate and push banking and financial markets leaders to move toward new cloud-based business architectures:

- Muted financial performance

- Accelerated digital adaptation

- New cloud-based business architectures

- Escalating competition

- Operational resilience challenges

- Increasing open and free data

- Security and fraud risks

- New ways of working

Let’s explore together why increasing open and free data is creating opportunities for cloud-native competition.

We are aware that the financial services industry has access to vast amounts of rich data about clients—data that is becoming cheaper and increasingly open. This prompts new opportunities to differentiate on personalized services improving business performance, and fast-track innovation to compete on platform economies (see, “Banking on the platform economy”). In doing so, well-designed and compliant data strategies are required to enable a transparent balancing act between ownership of data and sharing data, and insights across entire ecosystems.

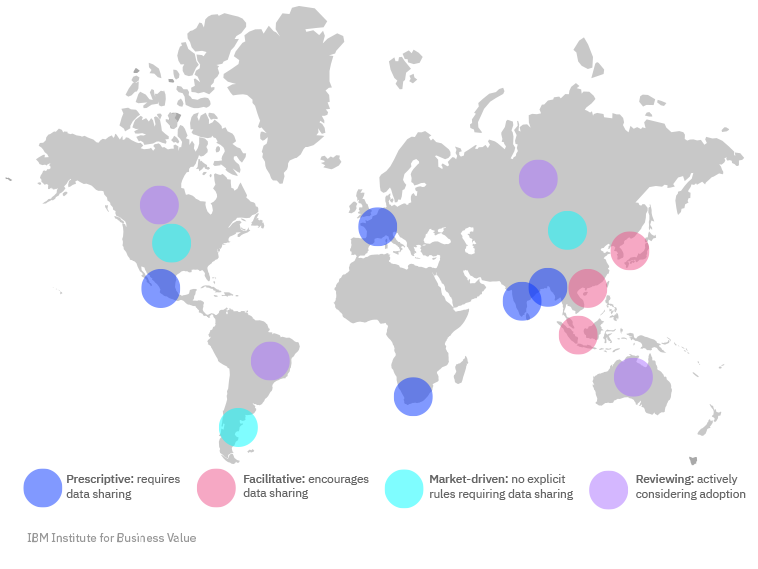

A data strategy needs to address regulatory requirements and anticipate any change across jurisdictions to harness the benefits of ecosystem interactions. Oversight on data openness varies geographically but typically includes fundamental consent, privacy expectations, and security requirements (see the recent Bank of International Settlement report, “Report on open banking and application programming interfaces”).

- Prescriptive jurisdictions. EU member states, UK, India, South Africa, and Mexico require, by regulation, that banks share customer-permissioned data, and that third parties register with the assigned supervisory authority.

- Facilitative jurisdictions. Singapore, Hong Kong, South Korea, and Japan had their regulators issue guidance and recommendations, publishing open API standards and technical specifications.

- Under review jurisdictions. In Canada, Australia, and Brazil, regulators are openly discussing the drafting of open-banking requirements and specifications.

- Market-driven jurisdictions. In mainland China, US, and Argentina, open-banking practices are primarily driven by industry implementations.

Main open banking initiatives and approaches across jurisdictions

The regulatory context is evolving rapidly and positively, increasing competition and opportunities to deliver value for the client. For example, the European Financial Dataspace promotes data-driven innovation supported by appropriate cloud infrastructure. By design, it will help new entrants become clients’ main touch point in aggregating data and services—a function that’s currently dispersed across multiple interactions.

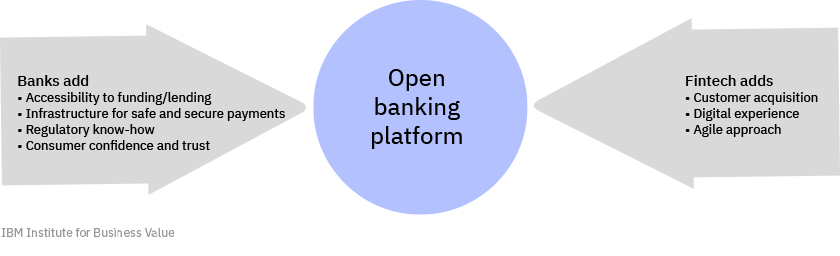

All intermediaries are asked to demonstrate full respect of privacy and utmost security standards to build and maintain their clients’ trust. By working collaboratively and leveraging the strengths of each party, exciting new opportunities can be created with a more open and cooperative outlook that capture the market’s attention. For example, banks add regulatory know-how to match fintech agile approaches.

Getting ready for advancing cloud adoption and data usage powered by AI

In this competitive and evolving environment, forward-looking banks are acting on their data to win revenue-generating interactions with open ecosystems. They are designing—and in many cases, have already deployed—AI models on open platforms to accelerate business adaptation to changes in the economy and client expectations. They are investing to demonstrate trustworthiness of AI-driven outcomes.

These following three action items allow banks to leverage increasingly open and free data to drive value for all stakeholders (clients, fintech, and financial institutions):

- Open ecosystems of partners, suppliers, and clients. Leading institutions collaborate beyond borders, sharing data and insights with network partners twice as much as less performing competitors (see, “Build the trust advantage”). They share core skills to engage clients within non-banking ecosystems. The key to success is the ability to share data openly and securely within the community, leveraging open standards and APIs.

- Open platforms to create and train AI models. The financial services sector is abundant with domain-specific information but also requires client context to deliver the best customized service. Open data is the best way to enrich the data sets required to train the models. To achieve “AI readiness” in their operations, leading institutions have built platform interactions capable of performing analytics among large sets of data, processes, and people.

- Open and trusted data. Trust is the major currency in financial services. Explaining strengths and weaknesses of predictions, as well as managing modeling risks to make processes robust, transparent, and fair, are quintessential requirements to leverage increasingly open and free data to power AI at scale implementations. Typically, data scientists dedicate significant effort to revising inputs and outputs of machine learning models. Well-designed and transparent open data strategies can accelerate the steps of the process. Availability of trusted sources may be limited at the present time, but the market dynamics indicate that data partnerships and higher collaboration will advance together with open banking agendas.

I firmly believe that data-driven decisions, insights, and recommendations based on AI and analytics must be transparent, explicable, and robust. A strong foundation for business transformation starts with a data management strategy that is grounded on open hybrid multicloud business architectures to enable secured and responsive collaboration models for open banking.

A balancing act for data collaboration and data partnerships

Federated learning is a collaborative approach for building AI models across decentralized organizations, holding local data sets without having to formally exchange them. These "open models" are duly trained by a diverse and agile global community making it possible for AI algorithms to gain experience from a broad range of data across various sites.

Users download the model to their devices, then train, compute, and update the model with local data. This type of AI model learning is becoming mainstream in the interactions between private and public users. To a certain extent, it allows mitigating issues, such as data privacy or data access, while delivering the value of an open data approach. Data readiness is a critical pre-condition for capturing value.

Attributes such as cleanliness, standards, openness, and permissions are essential for delivering sustainable innovation and deploying intuitive services. According to a recent IBV study, 80% of the effort in deploying AI technology is getting data ready for use (see, “Digital acceleration – Technology is driving revenue growth in time of crisis”).

To address these compelling issues, the industry has started building data partnerships and launching information banks, and it will continue to do so in 2021.

- Business critical data partnerships. Consortium and public-private partnerships enable harmonized data acquisition and sharing to power the application of machine learning models across datasets. For example, Transaction Monitoring Netherlands (TMNL) is a cross-banking initiative by five Dutch banks to fight money laundering and the financing of terrorism. TMNL will focus on identifying unusual patterns in payments traffic that individual banks cannot identify.

- The rise of information banks. Consumers increasingly demand transparency, as dissatisfaction grows with how technology giants use personal data. “Information banks” are business solutions offered to clients that compensate for the provision of data. For example, Satellite broadcaster Sky Perfect JSAT Holdings and personal loan provider J. Score are among the companies setting up information banks, giving users greater control over data distribution.

Leadership in the era of data and AI everywhere

I invite all business leaders to act and compete in the digital economy by evolving to modern data architectures. Consider implementing the following recommendations:

- Win in the trust economy. Provide transparency and reciprocity in all data operations, giving customers what they value in return for their data.

- Build a human-tech partnership. Empower employees to become citizen scientists. Expanding everyone’s horizon about what data can do allows your business to leverage the power of open hybrid multi-cloud to provide scale for data proliferation as data becomes increasingly open and free.

- Share data in the platform era. Be restless and look for deeper insights into clients, markets, and competitors, while creating security, transparency, and accountability for data that runs through your business platforms, well beyond your enterprise’s borders.

For more insights about how to achieve business excellence with new business architecture that can leverage open and free data on open hybrid multicloud, I encourage you to download the latest IBV paper “Banking on open hybrid multicloud.”

Meet the author